In recent years, the European Union (EU) has emerged as a global leader in sustainability, implementing a comprehensive set of frameworks, regulations, and initiatives to address environmental, social, and governance (ESG) challenges. From achieving climate neutrality to preventing greenwashing, these policies aim to create a sustainable, transparent, and inclusive economy. Whether you’re a business owner, investor, or sustainability professional, understanding these frameworks is essential to staying compliant and competitive in today’s evolving landscape.

Key Takeaways for Businesses and Stakeholders

- Stay Informed: The EU sustainability landscape is constantly evolving. Regularly review updates to regulations like the CSRD, SFDR, and Green Claims Directive.

- Embrace Transparency: Accurate ESG reporting and compliance with frameworks like the EU Taxonomy build trust with investors and stakeholders.

- Prepare for Accountability: New regulations on due diligence and green claims mean businesses must substantiate their sustainability efforts with measurable impact.

- Leverage Innovation: Tools like Digital Product Passports and the ESPR enable businesses to integrate circularity into product design and lifecycle management.

1. The Foundations of Sustainability in the EU

The EU’s approach to sustainability is guided by two cornerstone initiatives:

- The European Green Deal: The EU’s roadmap to achieve climate neutrality by 2050. It focuses on decoupling economic growth from resource use and includes ambitious goals for renewable energy, energy efficiency, and inclusive growth.

- The Circular Economy Action Plan: A strategy to reduce waste and extend the lifecycle of products by promoting design for repair, reuse, and recycling, particularly in high-impact sectors such as electronics, plastics, and textiles.

Together, these initiatives set the stage for a more sustainable Europe by aligning environmental, economic, and social goals.

2. ESG Reporting and Transparency

Transparency is at the heart of the EU’s sustainability efforts, with several key directives shaping how businesses disclose their environmental and social impacts:

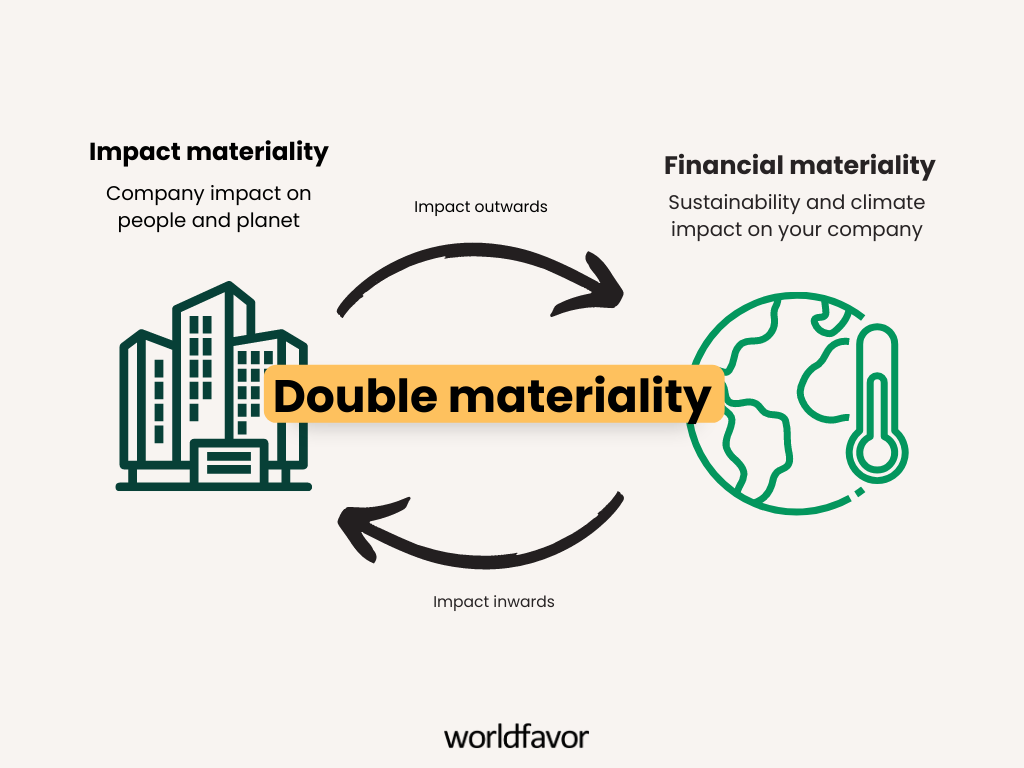

- Corporate Sustainability Reporting Directive (CSRD): Expanding on the Non-Financial Reporting Directive, the CSRD requires large companies to report on both financial materiality (how sustainability impacts their finances) and impact materiality (how their activities affect people and the planet). Reports must adhere to European Sustainability Reporting Standards (ESRS), ensuring consistency and reliability.

- Sustainable Finance Disclosure Regulation (SFDR): Targeting financial institutions, the SFDR mandates ESG disclosures at both the entity and product levels, helping investors understand the sustainability impact of their portfolios and reducing greenwashing.

- EU Taxonomy: A classification system that defines which economic activities are considered environmentally sustainable. Companies must disclose how their activities align with the taxonomy, providing clarity to investors and stakeholders.

3. Combating Greenwashing

As sustainability becomes a key differentiator in the market, the EU is taking firm steps to prevent greenwashing:

- Green Claims Directive: This regulation requires businesses to substantiate environmental claims, such as “eco-friendly” or “carbon neutral,” with scientific evidence. Starting in 2026, penalties for non-compliance will ensure accountability and build consumer trust.

- Digital Product Passport (DPP): Part of the Circular Economy Action Plan and the Ecodesign

.png) for Sustainable Products Regulation, the DPP provides detailed information on a product’s composition, environmental impact, and lifecycle. It empowers consumers and businesses to make informed decisions and promotes circularity by facilitating repair and recycling.

for Sustainable Products Regulation, the DPP provides detailed information on a product’s composition, environmental impact, and lifecycle. It empowers consumers and businesses to make informed decisions and promotes circularity by facilitating repair and recycling.

4. Mandatory Due Diligence and Supply Chain Responsibility

The EU is increasingly holding companies accountable for their environmental and social impacts:

- Corporate Sustainability Due Diligence Directive: Requires large companies to identify and mitigate human rights and environmental risks across their value chains, ensuring responsible sourcing and production.

- EU Deforestation Regulation (EUDR): Effective from December 2024, this regulation bans the sale of products linked to deforestation. Businesses must prove that their supply chains are deforestation-free, addressing a critical driver of climate change.

5. Frameworks Supporting Climate and Circularity Goals

Several other policies align with the EU’s broader sustainability agenda:

- Ecodesign for Sustainable Products Regulation (ESPR): Establishes product requirements to enhance durability, reusability, and repairability, making sustainable products the norm.

- Fit for 55 Package: A legislative suite aimed at reducing greenhouse gas emissions by 55% by 2030, covering carbon pricing, renewable energy targets, and energy efficiency measures.

- Renewable Energy Directive (RED II): Sets binding targets for renewable energy adoption, accelerating the transition away from fossil fuels.

- EU Emissions Trading System (EU ETS): A cap-and-trade system that limits total greenhouse gas emissions from industrial sectors, incentivizing sustainable practices.

6. Materiality and Responsible Reporting

To align with these frameworks, companies must conduct materiality assessments:

- Double Materiality: As required by the CSRD, businesses must consider both financial materiality (how sustainability affects their bottom line) and impact materiality (how their operations affect the environment and society).

This approach ensures that sustainability reporting is not just about compliance but about understanding and managing risks and opportunities holistically.

7. Financing a Green Transition

The EU is leveraging financial markets to drive sustainability:

- EU Green Bond Standard: A framework for issuing bonds aligned with the EU Taxonomy, ensuring transparency and credibility in green financing.

These initiatives provide businesses and investors with the tools to fund projects that contribute to climate goals while avoiding greenwashing.

The EU’s sustainability framework is comprehensive and ambitious, setting a global benchmark for environmental and social responsibility. For businesses, aligning with these regulations is not just about compliance—it’s an opportunity to innovate, build resilience, and contribute to a greener future. By understanding and integrating these frameworks, companies can position themselves as leaders in the transition to a sustainable economy.

References: